Governance, Risk & Compliance - Solutions in the area of IPO Readiness

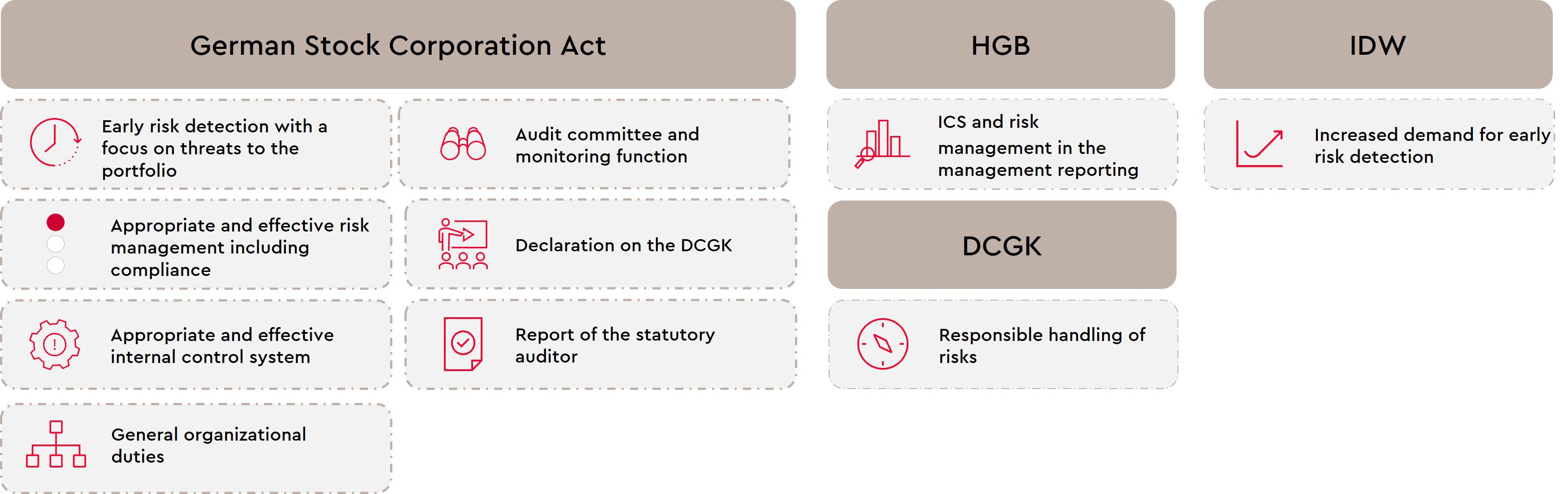

Corporate governance forms an essential part of the capital market requirements in the context of an IPO. In the context of an IPO, companies must create a legal and factual regulatory framework for management and supervision. This regulatory framework is based on the totality of all international and national rules and regulations and is reflected in the values and principles, processes and documentation that companies create for themselves. The regulatory requirements relate in particular to the familiar monitoring functions such as

and makes them the responsibility of the supervisory bodies and the management of companies.

In addition, of course, there are further obligations on the part of the Supervisory Board and management. In addition to the statutory obligations, further requirements arise from the intended place of listing (national or international) and the type of listing (e.g. Prime Standard vs. free market). In addition, implicit requirements arise from the capital market or from the future investors. In the course of our IPO consulting, we analyze existing monitoring functions and help you to establish IPO readiness in the area of Governance, Risk & Compliance.

Your challenges in the context of IPO readiness with regard to GRC

Companies face a variety of challenges when implementing corporate governance requirements in the context of IPO readiness:

- Time pressure in the IPO process, so that governance issues are implemented quickly and only incompletely

- High organizational and administrative effort in the implementation of governance functions and in further operations

- Frequently low acceptance of governance regulations and tasks within the organization

- Subsequent effort and high costs to optimize existing approaches and procedures after the IPO

Our solution approaches for your challenges

-

Determination of position and derivation of a pragmatic implementation plan for timely implementation of GRC systems

- Implementation of the necessary GRC functions, taking into account requirements for SOX readiness if necessary

- Efficient integration of corporate governance requirements into the IPO process

- Optimization of existing GRC functions with regard to capital market and other requirements

If you are interested and have any questions, please do not hesitate to contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!