Fairness Opinion

In 2005, the "Business Judgement Rule" was incorporated into the German Stock Corporation Act - in the M&A practice of business consulting (Mergers & Acquisitions practice), this regulation has manifested itself in the form of the "Fairness Opinion". It makes it easier for management, in particular listed companies, to demonstrate to shareholders and other stakeholders that the due diligence obligations pursuant to section 93 of the German Stock Corporation Act have been fulfilled. This is particularly important if the company valuation in the course of a purchase or sale of a company by an interested party such as an investment bank, a corporate finance advisor or, under certain circumstances, also your own M&A Department has been created. The fairness opinion is therefore understood as an opinion or a report of an independent expert to assess the appropriateness of an offer price.

Calculate Fairness Opinion

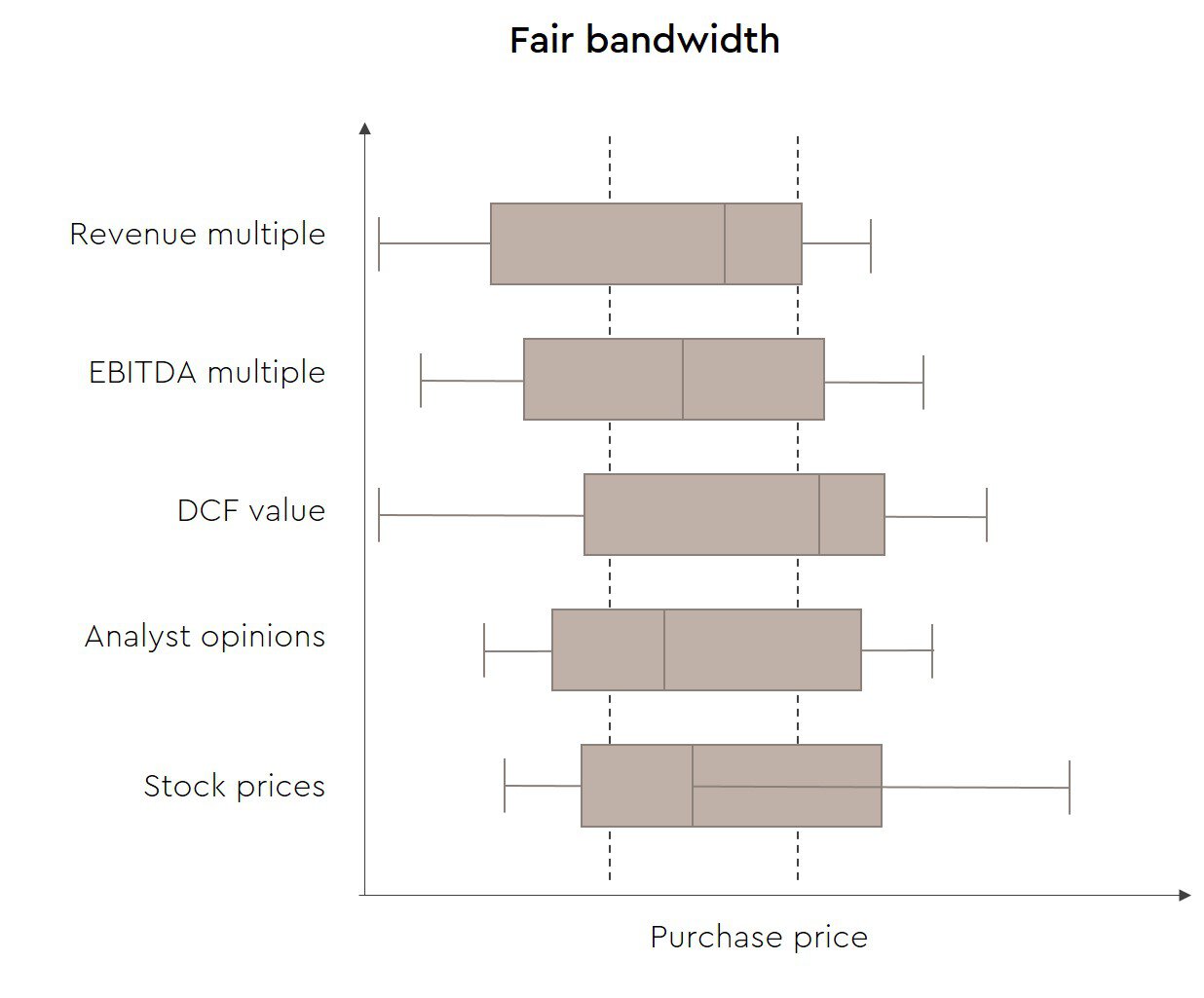

Unlike a typical valuation method, it does not claim to determine the correct "transaction price" such as the exact price of a share. Rather, a range of possible transaction prices is estimated, if the specific offer price is within the range, it is qualified as fair. In this way, the value of a company is documented in its current state for the purpose of proof that excludes liability.

Reasons for a fairness opinion

- Management Buy Outs

- Independent valuation as part of an acquisition (2nd opinion)

- Corporate M&A transactions - acquisition and sale

- Acquisition and sale by private equity or venture capital investors

Evaluation procedure & creation

As part of the preparation of a fairness opinion, we use the well-known German standards of the Institute of Auditors (IDW) or the German Association for Financial Analysts (DVFA). Usually several methods are used to determine the bandwidth of the offer prices (IDW S8 or DVFA standards). First approach to evaluation: Regularly different company value multiples. The possible price of a target company is estimated on the basis of comparable transactions or stock exchange prices of comparable companies in the same industry. Based on various key figures, an initial bandwidth is estimated using these multiples. In a second step, significantly more complex discounted cash flow procedures are regularly used - several scenarios of corporate planning are derived. The generally accepted capital asset pricing model is used to calculate the company’s cost of capital using capital market data. Based on the planning scenarios and the cost of capital, a range of possible company values is determined. Finally, the results of discounted cash flow and multiple procedures are compared with the present offer price. If this is within the determined bandwidth, it is qualified as fair.

Result of the Fairness Opinion

The result of the evaluation is divided into two parts. In the so-called Opinion Letter, the expert merely comments in general on the value, on the methods used to determine appropriate values and ultimately on whether a fair transaction price is offered here. The opinion letter is published by capital market-oriented companies. The opinion thus also serves as an instrument for communication with critical shareholders. The Valuation Memorandum is not publicly available - this contains the documentation regarding the determined company value ranges, corporate planning and, consequently, competitive data. It is necessary for the respective corporate body to understand and check the valuation concept here. This is the only way to meet the requirements of the Business Judgement Rule and the German Stock Corporation Act 93 Proof of Due Diligence.

Fairness Opinion - a service of WTS Advisory

WTS Advisory has extensive expertise and years of experience in the preparation of an independent fairness opinion and subsequent advice, in particular on a company sale or acquisition.

Get in touch with us

We will be happy to discuss your questions and current challenges with you!

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!