Impairment test according to HGB and IFRS

Importance of the impairment test for companies

On average, the market value of a European listed company is more than twice as high as its book value. To be more precise, investors attach a value to companies that is 2.5 times the reported equity. In the case of a company acquisition, this difference between market value and book value is reported in goodwill in the acquirer’s balance sheet. Due to the strong M&A activities (business consulting) /company acquisitions of recent years, goodwill has become the most important balance sheet position for many companies. For example, if General Electric, the largest company in the world, had to write off goodwill on the balance sheet, this would be equivalent to a loss of more than 70% of equity. The impairment of the investment is just as significant as the goodwill for the consolidated financial statements. The steadily growing importance of goodwill has not remained hidden from the auditing companies and the Federal Financial Supervisory Authority (BaFin). Consequently, these positions are often examined with a focus. The experienced consultants of WTS Advisory will accompany you safely through the holistic impairment testing process.

Structuring of impairment tests

Impairment tests must be carried out in accordance with HGB and IFRS. In international accounting, IAS 36 regulates the procedure for the impairment test. Goodwill is therefore tested at the level of the operating segments for impairment at least once a year. Put simply, this is the structure by which the management controls the company.

The asset impairment test is based on smaller units, so-called cash generating units (CGUs). This is only necessary if there is an indication of a depreciation (triggering event). In this context, it is important that an early detection system is installed for these triggering events. In this way, it can be avoided that indications are not recognized and that a necessary impairment is subsequently avoided. Often corresponding processes are already present in the company, but not sufficiently documented.

For the valuation of investments according to HGB or specifically IDW RS HFA 10, the legal structuring is not relevant but the internal reporting. See also the diagram above. Both tests follow a company valuation with certain specifics, whereby for HGB the equity value is relevant for finance, according to IFRS the enterprise value.

Overall, it is important that the IFRS and HGB tests can be coordinated - otherwise, corresponding comments from auditors or BaFin are to be expected. We support you in structuring the various impairment tests and help you generate the necessary documentation in the Group.

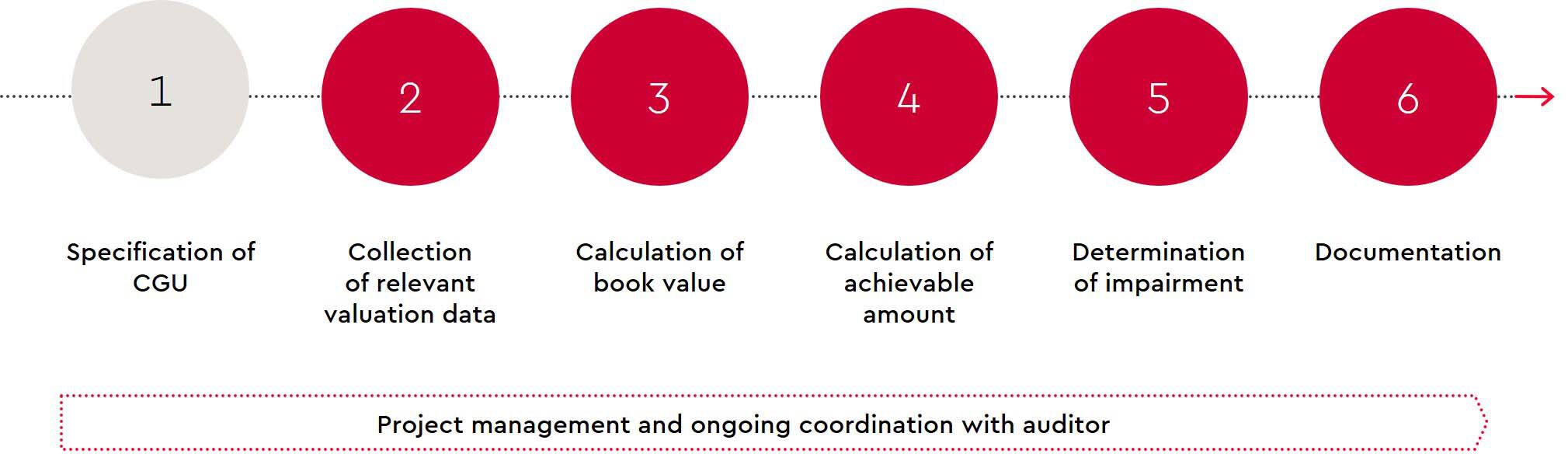

Procedure of an impairment test After determining the CGU structure of the impairment test, the actual test procedure is always identical:

Relevant evaluation data

For later valuation, a discounted cash flow method is usually used. The necessary business plan is at least partially available in most companies. We can support you in setting up corporate planning, extending a one-year budget over time or extending pure P&L planning to carry out the balance sheet and cash flow statement. We are also happy to check the plausibility of your planning for you. In addition, we also calculate the weighted capital costs and coordinate them with your auditor.

Calculation of the carrying amount

In particular, the principle of equivalence must be observed when determining the carrying amount. It should therefore be borne in mind that the calculation should coincide with the derivation of the cash flows - otherwise an unjustified impairment may occur. Since the recoverable amount in its characteristics represents an enterprise value, it must be compared with the operating net assets.

Calculation of the recoverable amount

The recoverable amount of the CGUs ("recoverable amount") corresponds to the higher amount of fair value ("fair value") and utility value ("value in use"). Both values are results from a discounted cash flow model. The determination is specified by deriving the underlying cash flows. For example, the value in use must be adjusted for restructuring effects, the fair value may only include those planning components that an average market participant would set.

Determination of the impairment

Finally, the recoverable amount and book value of the CGUs are compared, hopefully no impairment is detected. Apart from the CGU structure, asset and goodwill impairment tests are largely identical. However, the calculation for the valuation of investments according to HGB is somewhat different, but these values can usually be easily overruled.

Final documentation of the results

After conducting the impairment test, the WTS Advisory consultants will prepare appropriate documentation for you that meets the requirements of your auditor as well as any subsequent enforcement proceedings by BaFin.

Get in touch with us

We will be happy to discuss your questions and current challenges with you!

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!