Post Merger Integration in Corporate Acquisitions or Investments

If private equity investors or capital market corporations take a stake in a company, this is usually connected with significant challenges for the new stakeholding companies, particularly for their finance departments. This is especially the case with investments in previously more midsized companies or privately owned companies.

In M&A activities or specifically pre-merger activities such as due diligence and corporate valuation, a clear trend has been seen in recent years – external experts such as lawyers, auditors, tax consultants, and investment bankers are increasingly integrated in this early phase. Diligent planning of the post-merger integration have often been neglected. In practice, however, it is precisely here that we find the most frequent reasons for why the target financial goals of the transaction are not met. In particular, problems and risks arise from the areas listed below.

Typical Risks from Post-merger Integration

Synergy risks

Sources of risks that come from a lack of planning for the implementation of synergies. This is often due to the fact that there is no sustainable implementation concept or plan ready for the post-merger integration.

Structure risks

Risks from differing organizational structures between the buyer and the company being bought. Accounting risks, for example, accounting standards, reporting levels, reporting speed, etc.

Personnel risks

Employee resistance to the transaction and integration coupled with decreasing identification of the employees with the company. Such effects can be found particularly among members of management.

Project risks

Obstacles to project-side implementation of the integration. Usually, the integration is transferred to the line managers, who often do not have the time available or lack experience in the field of PMI.

Success Factors for Post-merger Integration

Timely addressing of these risks simultaneously represents the most important success factor of a PMI. The risks show that suitable integration of a company should already be planned as part of the due diligence. Ideally, the managers responsible for the PMI have already been involved in the due diligence. Structural risks can thus be identified in due time as well. Communication to employees – individually and on the corporate level – should be carefully coordinated in order not to lose in particular the top performers of the target company. Furthermore, it is necessary to coordinate the capacities necessary for implementation of the integration strategy with department managers, particularly human resource managers.

Course and Plan of Project for Post-merger Integration

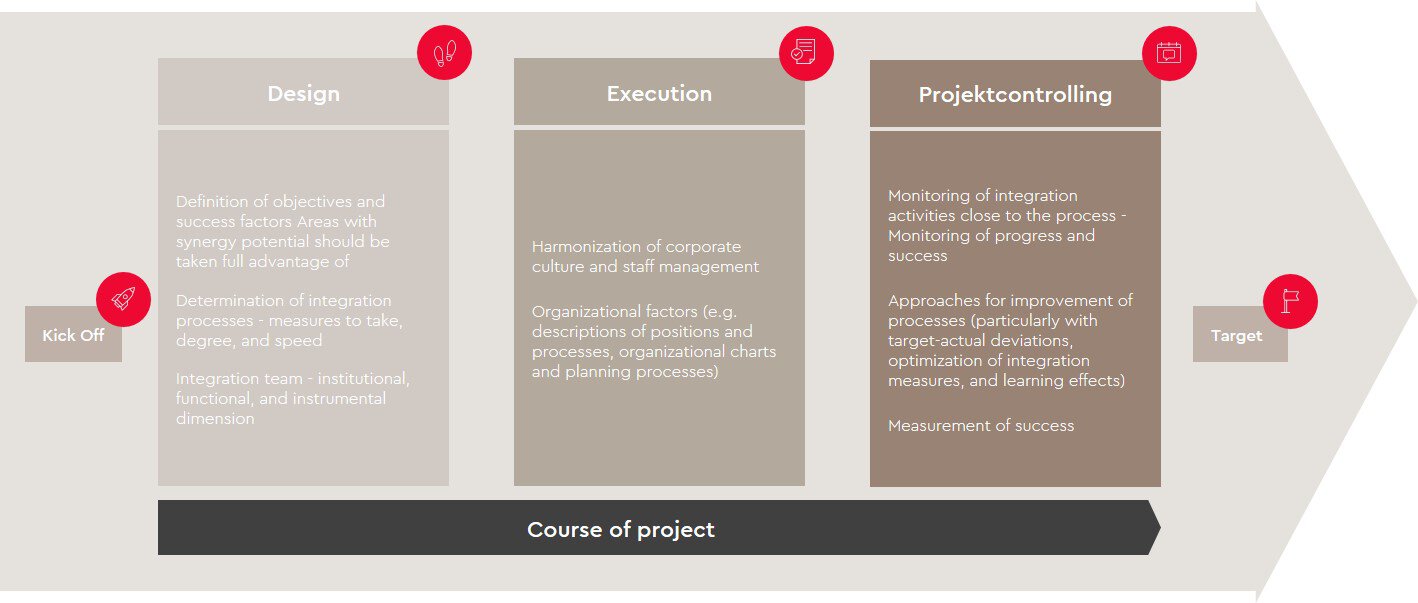

A generic course of a project for a PMI is summarized in the following diagram:

A rough design of the PMI should be carried out in the course of due diligence, as already described. Less extensive adjustments take place after closing if access to information on the target improves again. Significant parts of the implementation then occur in the first 100 days after closing.

Requirements for Participants in the PMI Process

The following summarized requirements apply in particular to the core areas of finance, accounting, treasury, and controlling, and show the additional need for staff in a qualitative and quantitative regard:

- If need be, a conversion to IFRS or the accounting system of the new parent company must be performed. This applies in particular to the standardization and combination of processes and methods for the preparation of financial statements, i.e. the development of joint account assignment guidelines and accounting guidelines.

- Furthermore, a first-time preparation of consolidated financial statements or consolidated reporting might be necessary for consolidated financial statements.

- Appropriate fast close processes and the required IT background are necessary for quick preparation of financial statements, particularly against the backdrop of potential interim financial statements.

- If the annual or consolidated financial statements will be audited by a Big 4 auditing firm in the future, the qualitative requirements for the preparation of the financial statements will increase.

- The implementation of processes for active liquidity management, particularly for a liquidity forecast, also in regard to potential cash covenants, must be completed. In some cases, the banks that have financed the transaction require separate reporting. Failure to provide these figures on time often leads to termination of the loan.

- The quality requirements for adequacy of the budget and the planning processes usually increase in the case of publicly listed companies, since this information must also persuade shareholders in the future as well.

Support & Consulting by WTS Advisory for Post-merger Integration

As part of financial due diligence during the transaction process, we provide support for planning the financial part of the post-merger integration. After a successful closing, a portion of the due diligence team will remain on-board so that the prepared knowledge is not lost and can be used for implementation of the PMI strategy. Irrespective of whether previous financial due diligence was performed, WTS Advisory brings an extensive trove of experience from numerous PMI projects for your business. We ensure that the sought synergies are actually exhausted and the desired effects occur in order to actually generate the planned corporate value for you.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!