ESG Solutions - Sustainable corporate governance

Global climate change is just one of many effects of a changing world. Famine, pollution of the oceans, child labor and scarcity of raw materials are also among the sad truths of our time. Only a concerted effort by global politics, business and society can adequately address these challenges. The Paris Agreement on Climate Protection and the Sustainable Development Goals (SDGs) that emerged from it play a central role in this.

Sustainable, responsible, corporate action and economic activity – these factors reflect the focus of society's expectations of companies – and determine their long-term success today and in the future. The central questions here: What impact does the company's business have on the environment and society? How does sustainability influence the business model? What sustainable financing options are available?

Stand-alone financial figures and rigid facts are no longer sufficient to maintain the interest and trust of stakeholders. A transparent, non-financial reporting is required, which demonstrates that companies are aware of the environmental and social impacts of their business activities and take responsibility. Capital market-oriented companies already have to publish this information in a non-financial (group) statement in accordance with German Law (Section 289b and Section 315b of the German Commercial Code (HGB)). With increasing importance and growing interest of society, there are considerations to extend the obligated circle of users. However, even companies that are not required to publish a non-financial statement can derive strategic and economic benefits from an increased focus on sustainability.

Sustainability is a cross-cutting issue that affects the entire company. The various aspects of sustainability must be analyzed in full, as they are essential for a long-term and sustainable corporate strategy. ESG factors are becoming increasingly important not only for investors, but also for lenders. Furthermore, legal requirements are constantly being expanded. Data collection and validation in this area is generally not standardized and regularly presents companies with very significant challenges. In order to bring the social, ecological and economic factors into a context, overarching processes must be established and ESG risks must in turn be systematically anchored in risk management.

If the transparency needs of internal and external stakeholders are met and sustainable corporate governance is disclosed, this influences the company's external image and also pays off economically – such as through competitive advantages, an improved reputation or an increase in employer attractiveness.

Our ESG Solutions

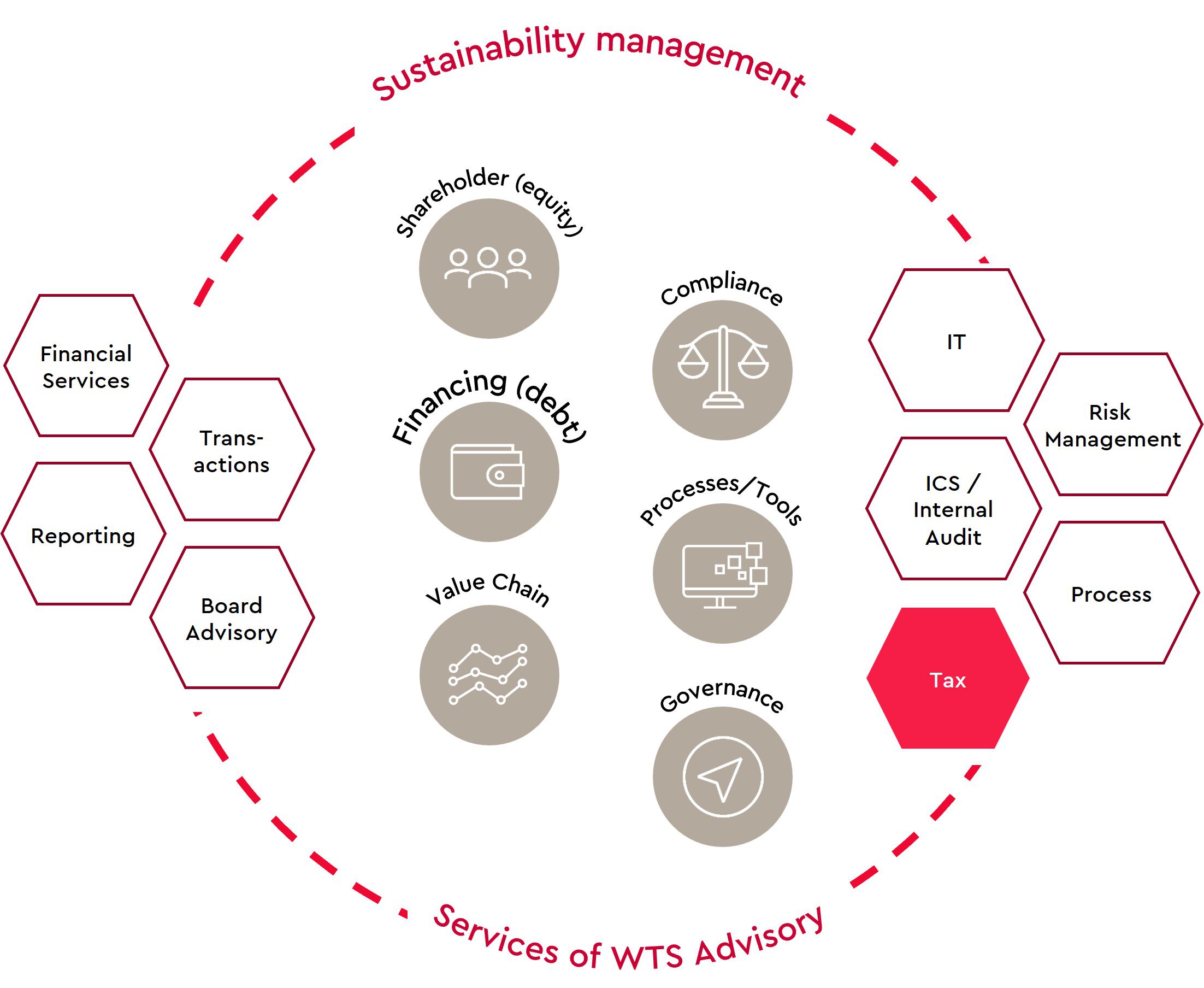

To meet the requirements for the ESG reporting, we provide you with full support from our interdisciplinary teams and experts from the areas of Financial Reporting, Financial Services, Finance Processes, Risk & Compliance and Digital Architects.

Our service spectrum ranges from full project takeover including project management to support with individual sub-areas or even selective activities. Accordingly, we can tailor our consulting approach to best involve your employees with the desired and possible deployment.

If you are interested or have any questions, please do not hesitate to contact us.

WHAT IS THE DIFFERENCE BETWEEN CSR AND ESG?

CSR – Corporate Social Responsibility describes the social responsibility for sustainable development of a company. A characteristic feature is the voluntary basis of the approach, which thus goes beyond what is required by law. CSR is also used in the CSRD as an abbreviation for the Corporate Sustainability Reporting Directive.

ESG – Environment Social Governance describes the environmental and social areas of corporate governance. Sustainability and effective governance are placed at the center of corporate policy.

While CSR aims to hold a company accountable, ESG criteria make the actions taken measurable. Since CSR activities vary greatly from company to company and industry to industry, there is a lack of comparable metrics. ESG criteria, on the other hand, are usually quantifiable to a much higher degree.

WHAT DOES ESG MEAN?

ESG stands for Environmental - Social - Governance and describes the three sustainability-related areas of responsibility of companies.

WHICH COMPANIES ARE AFFECTED BY THE CSR IMPLEMENTATION ACT?

Currently, large companies with capital market orientation and an annual average of more than 500 employees, as well as large credit institutions, financial services companies and insurance companies/groups are required to provide non-financial reporting as well as non-financial risk reporting in accordance with §289b; §289c (3) HGB.

ARE THERE ANY INTERNATINAL FRAMEWORKS RELATING TO SUSTAINABILITY?

There are various frameworks. The Global Reporting Initiative (GRI), supports the sustainability reporting of all organizations and has developed a comprehensive framework for sustainability reporting that is applied worldwide. Other internationally established frameworks include the Sustainability Accounting Standards (SASB) or the Task Force on Climate-related Financial Disclosure (TCFD). So far, however, there is no binding framework, which is, however, demanded by various institutions (e.g. IDW/DRSC, EU Commission) and the applying industry. The IFRS Foundation is currently discussing the establishment of a Sustainability Standard Board and the creation of international standards. At the same time, the EU has commissioned EFRAG to develop EU sustainability standards.

WHAT IS BEHIND THE EU TAXONOMY?

The EU taxonomy defines an EU-wide technical system for classifying green (sustainable) economic activities and aims to create a common understanding of the sustainability of economic activities. This is intended to direct financial resources towards priority green activities to achieve the goal of climate neutrality for Europe by 2050, as well as to limit/avoid "green-washing".

WHAT KEY FIGURES ARE INCLUDED IN THE "GREEN FINANCIAL INDICATORS"?

The "Green Financial Indicators" include information on the environmentally sustainable share of sales revenue, capital expenditures (CapEx) as well as operating expenditures (OpEx).

Revenue: Share of sales of products or services related to environmentally sustainable economic activities.

CapEx and OpEx: Share of total capital expenditures (CapEx) and/or share of operating expenditures (OpEx) related to assets or processes associated with environmentally sustainable economic activities.

Another delegated act expected to be published in June 2021 is expected to provide further clarification on the exact content and presentation of the required reporting information, including the methodology to be used to calculate the indicators (turnover, CapEx, OpEx).

HOW ARE THE NACE CODES RELATED TO THE EU TAXONOMY?

The NACE Code is a statistical classification of economic activities in the European Community. The NACE codes are used as a basis for identifying economic activities that are relevant for classification according to the EU taxonomy and are then categorized and evaluated in a further step according to the taxonomy specifications.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!