IRRBB – interest rate risks in the banking book

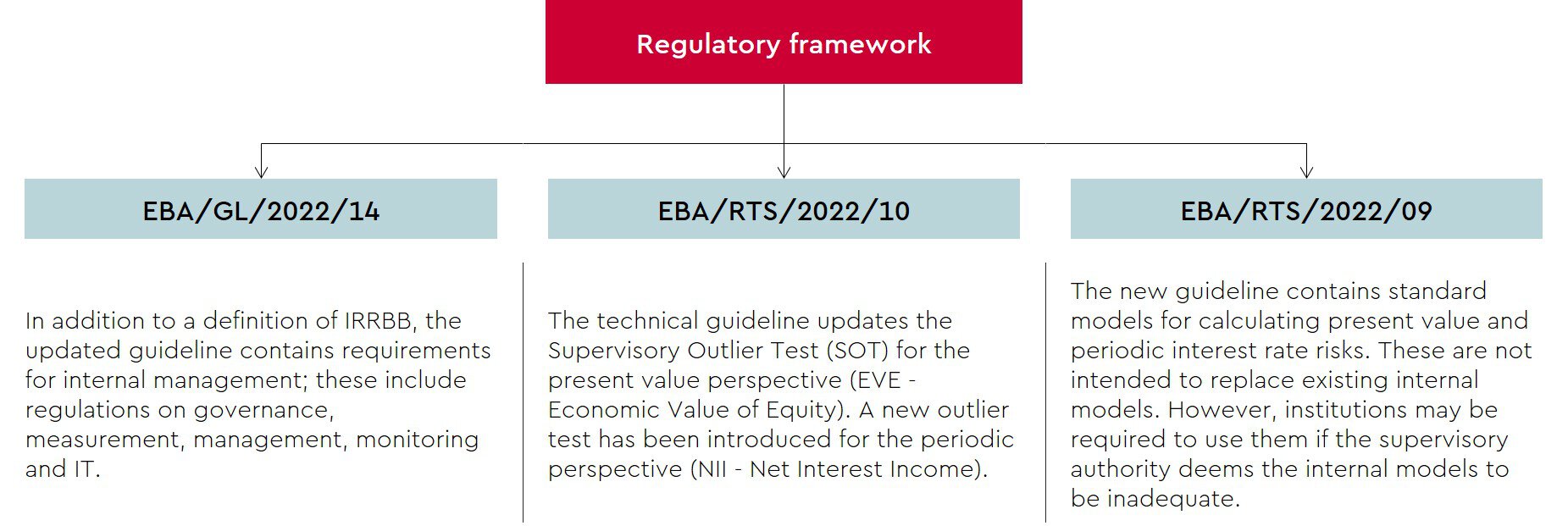

With the guideline (EBA/GL/2022/14), the European Banking Authority (EBA) published a new standard for the monitoring and management of interest rate risks in the banking book (IRRBB) on October 20, 2022. The standard replaces the guidelines (EBA/GL/2018/02) in force since 2018, which previously contained the regulations for interest rate risks in the banking book. As part of these new regulations, the EBA has published supplementary technical guidelines:

Measurement & management of interest rate risks according to IRRBB

The guideline distinguishes between two key figures for the measurement and management of interest rate risks:

-

Present value perspective (EVE approach): The focus is on the change in the present value of interest-bearing assets, liabilities and off-balance sheet items in the banking book in the event of a change in interest rates. The present value or market value for non-derivative products is generally determined by discounting expected future cash flows. The observation horizon is infinite, meaning that all cash flows up to the end of the transaction are taken into account. The calculation or measurement is based on a roll-off balance sheet assumption, i.e. that expiring business is not replaced.

-

Income-oriented perspective (net interest income approach): The focus is on the change in net interest income (NII) in the narrower sense, taking into account changes in market value, which can be reflected either in the income statement (IFRS: FVTPL) or directly in equity (IFRS: FVOCI). The NII approach examines the negative effects of the interest rate change on the periodic interest or interest-induced result. The calculation may have to be carried out under a so-called dynamic balance sheet development. This also requires the modeling of new business including notional closing of the balance sheet.

Different types of interest rate risks

-

Gap Risk: Risks in connection with incongruences between the term and the interest adjustment of assets and liabilities as well as off-balance-sheet current and non-current positions (interest rate adjustment risk) or risk in the case of changes in the steepness and form of the yield curve (yield curve risk).

-

Basic Risk: Risks in the hedging of an interest rate risk through a risk position that is revalued under slightly different conditions.

-

Option Risk: Risks associated with options, including embedded options, such as the sale of fixed-interest products by consumers when market interest rates change.

The German banking supervisory authority has incorporated the requirements of the EBA guideline into its “Minimum Requirements for Risk Management at credit institutions” with the 8th amendment.

Support of WTS Advisory with IRRB

WTS Advisory supports you and your company in analyzing your current system for measuring and managing interest rate risks in the banking book, identifying gaps in the new regulatory requirements, designing suitable adjustment measures and providing implementation support.

If you are interested or have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!