CSRBB - credit spread risks in the banking book

The management and monitoring of credit spread risks in the banking book (CSRBB) has had a rather subdued existence in the past. The focus of the supervisory authorities was primarily directed towards the regulation of interest rate risks in the banking book.

The EBA (European Banking Authority) finally closed this gap on October 20, 2022 with the publication of new guidelines (EBA/GL/2022/14). In addition to the updated requirements for managing and monitoring interest rate risks, credit spread risks are now also included in the regulatory framework and are thus established as a separate risk type.

Measurement and management of the CSRBB

CSRBB is defined as the risk that market-wide spread changes will affect the present value or the periodic result. Credit rating-related spread changes are not taken into account.

In addition to a definition of CSRBB, the guideline contains requirements for internal management, including regulations on governance, measuring, management, monitoring and IT, similar to the requirements for IRRBB.

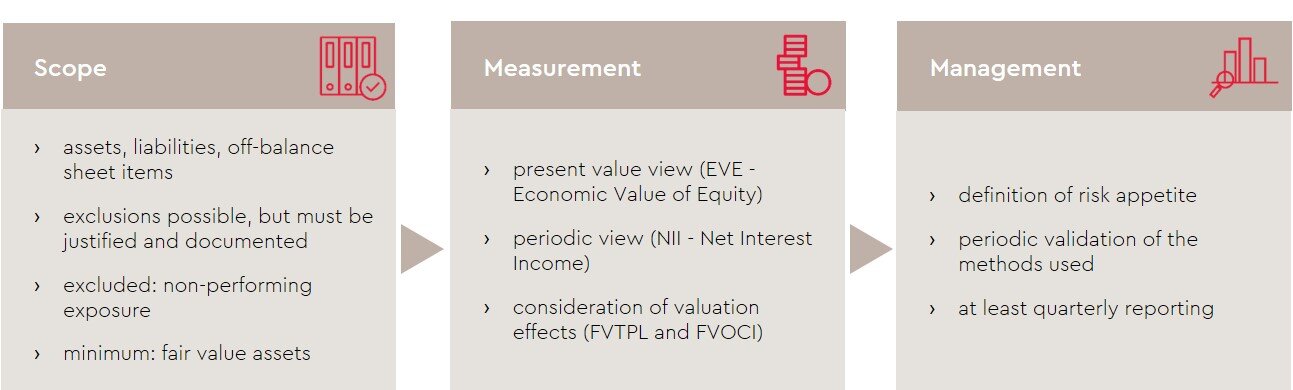

This does not only include assets, but also liabilities and off-balance sheet items, with exclusions of certain items being possible. Such exclusions must be appropriately justified and documented.

Risk measurement should be carried out from two perspectives, the present value and periodic perspective. To measure the CSRBB from the periodic perspective, valuation effects due to changes in market value must be taken into account in addition to interest income and expenses.

The extensive changes to the guideline for measuring credit spread risks also increase the requirements for appropriate management. Institutions are required to define their risk appetite with regard to fluctuating credit spreads, to regularly validate the methods used and to report regularly.

The requirements of the EBA guideline were included in the 8th MaRisk amendment.

Support of WTS Advisory with CSRBB

WTS Advisory supports you and your company in analyzing your current system for measuring and managing credit spread risks in the banking book, identifying gaps in the new regulatory requirements, developing suitable adjustment measures and providing implementation support.

If you are interested or have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!